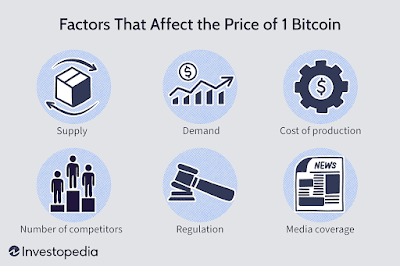

Factors That Affect the Price of 1 Bitcoin

source image: investopedia

Cryptocurrencies are a relatively new form of currency that

has become increasingly popular over the last few years. The rise of

cryptocurrencies has been accompanied by a surge in their prices, with some

cryptocurrencies reaching unprecedented levels in terms of value. However, the

cryptocurrency market is highly volatile, and prices can fluctuate

significantly in a short period. In this article, I will explore the factors

that affect cryptocurrency prices and provide an in-depth analysis of how they

impact the market.

Introduction to Cryptocurrency and Its Market

Cryptocurrency is a digital or virtual currency that uses

cryptography for security. It is a decentralized form of currency that operates

without a central authority, such as a bank or government. Cryptocurrencies are

created through a process known as mining, which involves solving complex

mathematical problems to validate transactions and secure the network.

The cryptocurrency market is a global and decentralized

market that operates 24/7. It is a highly volatile market that is subject to

rapid price changes. The market is relatively new, and it is still in its early

stages of development. As a result, it is subject to high levels of speculation

and manipulation.

Understanding Cryptocurrency Prices

Cryptocurrency prices are determined by supply and demand.

When there is a high demand for a particular cryptocurrency, its price tends to

increase. Conversely, when there is a low demand for a cryptocurrency, its

price tends to decrease. The supply of a cryptocurrency also plays a role in

determining its price. When the supply of a cryptocurrency is limited, its

price tends to increase.

The price of a cryptocurrency is also influenced by its

adoption rate. The more people use a particular cryptocurrency, the more

valuable it becomes. This is because the more people that use a cryptocurrency,

the more demand there is for it, which drives up its price.

Regulations and news events can also have a significant

impact on cryptocurrency prices. Regulations can either boost or hurt the

demand for a particular cryptocurrency. News events, such as a major hack or a

significant partnership, can also impact the price of a cryptocurrency.

Factors That Affect Cryptocurrency Prices

Supply and Demand

Supply and demand are the primary factors that affect

cryptocurrency prices. The supply of a particular cryptocurrency is limited,

which means that its price tends to increase when there is a high demand for

it. Conversely, when there is a low demand for a cryptocurrency, its price

tends to decrease.

The demand for a cryptocurrency can be influenced by several

factors. One of the most significant factors is the adoption rate of a

cryptocurrency. The more people that use a particular cryptocurrency, the more

demand there is for it, which drives up its price.

Other factors that can influence the demand for a

cryptocurrency include investor sentiment, media attention, and economic

conditions. If investors have a positive outlook on a particular

cryptocurrency, they are more likely to invest in it, which can drive up its

price.

Adoption

Adoption is another significant factor that affects

cryptocurrency prices. The more people that use a particular cryptocurrency,

the more valuable it becomes. This is because the more people that use a

cryptocurrency, the more demand there is for it, which drives up its price.

The adoption rate of a cryptocurrency can be influenced by

several factors. One of the most significant factors is the ease of use of a

cryptocurrency. If a cryptocurrency is easy to use and has a user-friendly

interface, it is more likely to be adopted by a wider audience.

Other factors that can influence the adoption rate of a

cryptocurrency include its security features, transaction speed, and overall

reliability. If a cryptocurrency is secure, fast, and reliable, it is more

likely to be adopted by a wider audience.

Regulations

Regulations can have a significant impact on cryptocurrency

prices. Governments around the world are starting to regulate cryptocurrencies,

which is both positive and negative for the market.

Positive regulations can boost the demand for a particular

cryptocurrency. For example, if a government were to recognize a particular

cryptocurrency as legal tender, it would increase the demand for that

cryptocurrency, which would drive up its price.

Negative regulations can hurt the demand for a particular

cryptocurrency. For example, if a government were to ban the use of a

particular cryptocurrency, it would decrease the demand for that

cryptocurrency, which would drive down its price.

News and Events

News and events can also have a significant impact on

cryptocurrency prices. Major news events, such as a significant hack or a major

partnership, can impact the price of a cryptocurrency.

Positive news events can boost the demand for a particular

cryptocurrency. For example, if a company were to announce that it was

accepting a particular cryptocurrency as payment, it would increase the demand

for that cryptocurrency, which would drive up its price.

Negative news events can hurt the demand for a particular

cryptocurrency. For example, if a significant hack were to occur, it would

decrease the demand for that cryptocurrency, which would drive down its price.

Factor That Create Bitcoin Volatility

source image: investopedia

Cryptocurrency Price Prediction - How to Forecast Cryptocurrency Prices

Cryptocurrency price prediction is a challenging task. The

cryptocurrency market is highly volatile, and prices can fluctuate significantly

in a short period. However, several methods can be used to forecast

cryptocurrency prices.

One of the most popular methods for forecasting

cryptocurrency prices is technical analysis. Technical analysis involves

analyzing past price data and identifying trends and patterns. By identifying

these trends and patterns, analysts can predict future price movements.

Another method for forecasting cryptocurrency prices is

fundamental analysis. Fundamental analysis involves analyzing the underlying

factors that influence cryptocurrency prices, such as supply and demand,

adoption, regulations, and news events. By analyzing these factors, analysts

can predict future price movements.

The Future of Cryptocurrency Prices

The future of cryptocurrency prices is uncertain. The

cryptocurrency market is highly volatile, and prices can fluctuate

significantly in a short period. However, several factors suggest that

cryptocurrency prices will continue to rise in the future.

One of the most significant factors that suggest cryptocurrency

prices will continue to rise is the increasing adoption of cryptocurrencies. As

more people use cryptocurrencies, the demand for them will increase, which will

drive up their prices.

Another factor that suggests cryptocurrency prices will continue

to rise is the increasing interest in the blockchain technology that underpins

cryptocurrencies. Blockchain technology has been hailed as a transformative

technology that has the potential to disrupt several industries.

Conclusion

In conclusion, several factors affect cryptocurrency prices,

including supply and demand, adoption, regulations, and news events.

Understanding these factors is essential for anyone looking to invest in

cryptocurrencies. While cryptocurrency price prediction is challenging, several

methods can be used to forecast future price movements. The future of

cryptocurrency prices is uncertain, but several factors suggest that they will

continue to rise in the future.